NCERT 10th Class (CBSE) Social Science: Money and Credit Quiz

29 Multiple Choice Questions related to NCERT 10th Class (CBSE) Social Science: Money and Credit Quiz:

- A bank is an institution that accepts the surplus deposits and grants loan to the people or businessmen.

- Because money is easily acceptable. A person holding money can easily exchange it for any commodity or service that he or she might want.

- Paper notes, coins and demand deposits constitute the modern money. Traditional forms of money which included gold and silver had its own value whereas modern currency is without any used of its own.

Quiz: Money and credit

The difference between what is charged from borrower and what is paid to depositors is the main source of income for the banks. The deposits with the bank which can be withdrawn on demand are known as demand deposits. It is an agreement in which the lender supplies the borrower with money, goods or services in return for the promise of future payment.

- Question 1 of 29

1.

Which one of the following statements is most appropriate regarding transaction made in money?

Correct

Wrong! Correct answer is It is the easiest way

- Question 2 of 29

2.

Which one of the following is the new way of providing loans to the rural poor?

Correct

Wrong! Correct answer is SHG’s

- Question 3 of 29

3.

Which among the following authorities issues currency notes?

Correct

Wrong! Correct answer is Reserve Bank of India

- Question 4 of 29

4.

Banks provide a higher rate of interest on which one of the following accounts ?

Correct

Wrong! Correct answer is Fixed deposits for long period

- Question 5 of 29

5.

Which one of the following is the main source of credit for rich urban households in India ?

Correct

Wrong! Correct answer is Formal sector

- Question 6 of 29

6.

Which one of the following is an essential feature of barter system?

Correct

Wrong! Correct answer is It requires double coincidence of wants.

- Question 7 of 29

7.

Which one of the following terms is not included against loans?

Correct

Wrong! Correct answer is Lender’s land

- Question 8 of 29

8.

What is main source of income for banks?

Correct

Wrong! Correct answer is Interest on deposits

- Question 9 of 29

9.

In which one of the following systems exchange of goods is done without use of money?

Correct

Wrong! Correct answer is Barter system

- Question 10 of 29

10.

Which of the following has an essential feature of double coincidence?

Correct

Wrong! Correct answer is Barter system

- Question 11 of 29

11.

What per cent of their deposits do bank hold as cash?

Correct

Wrong! Correct answer is 80 percent

- Question 12 of 29

12.

Which of the following is an asset that the borrower owns and uses as a guarantee until the loan is repaid to the lender?

Correct

Wrong! Correct answer is Collateral

- Question 13 of 29

13.

How many members a typical Self-Help Group Should have?

Correct

Wrong! Correct answer is 15 – 20

- Question 14 of 29

14.

In a barter system:

Correct

Wrong! Correct answer is Goods are exchanged without the use of money.

- Question 15 of 29

15.

About what percentage of their deposits is kept as cash by the banks in India?

Correct

Wrong! Correct answer is 15 %

- Question 16 of 29

16.

Why do banks keep a small proportion of the deposits as cash with themselves?

Correct

Wrong! Correct answer is To extend loan facility.

- Question 17 of 29

17.

The currency notes on behalf of the Central Government are issued by whom?

Correct

Wrong! Correct answer is Central Bank of India

- Question 18 of 29

18.

Which one of the following is not a feature of money?

Correct

Wrong! Correct answer is Lack of divisibility

- Question 19 of 29

19.

Professor Muhammad Yunus is the founder of which one of the following banks ?

Correct

Wrong! Correct answer is Grameen Bank

- Question 20 of 29

20.

Which one of the following is a modern form of currency ?

Correct

Wrong! Correct answer is Paper notes

- Question 21 of 29

21.

The Informal source of credit does not include which one of the following?

Correct

Wrong! Correct answer is Cooperative Societies

- Question 22 of 29

22.

Anything which is generally accepted by the people in exchange of goods and services __________

Correct

Wrong! Correct answer is Money

- Question 23 of 29

23.

Both parties agree to sell and buy each others commodities

Correct

Wrong! Correct answer is Double coincidence of wants

- Question 24 of 29

24.

Money acts as an intermediate in the exchange process. Which function of money is highlighted here?

Correct

Wrong! Correct answer is Medium of Exchange

- Question 25 of 29

25.

Money is accepted as a medium of exchange because the currency is authorised by ____________

Correct

Wrong! Correct answer is Government

- Question 26 of 29

26.

Deposits in the bank accounts can be withdrawn on demand, therefore these deposits are called ___________

Correct

Wrong! Correct answer is Demand deposits

- Question 27 of 29

27.

It is a paper instructing the bank to pay a specific amount from the person’s account to the person in whose name it has been made is ___________

Correct

Wrong! Correct answer is Cheque

- Question 28 of 29

28.

Banks use the major portion of the deposits to __________

Correct

Wrong! Correct answer is Extend loans

- Question 29 of 29

29.

An agreement in which the lender supplies the borrower with money, goods or services in return for the promise of future payment.

Correct

Wrong! Correct answer is Credit (loan)

Your Score:

Your Ranking:

Money and Credit Quiz Summary

Barter System: The barter system was used before the advent of money. People used to exchange one thing for another in this system.

Double Coincidence of wants: The double coincidence of wants is the major drawback of the barter system. It can be very difficult to find a person who can fulfill this condition. Suppose you want to barter your MP3 player with a game console, then you need to find a person who wants to barter his game console for an MP3 player.

Money

Money is a means by which we can get something in exchange. Initially, coins came into use. The coins were initially made of precious metals; like gold and silver. When the precious metals became too precious, ordinary metals were being used for making coins. Paper money or currency notes gradually took place of coins; although coins of smaller denominations are still in use.

The currency notes and coins are issued by the government of an authorized body. In India, the RBI (Reserve Bank of India) issues currency notes. On the Indian currency note, you can find a statement which promises to pay the bearer the amount which is mentioned on the currency note.

Advantages of Money:

- Removes the coincidence of wants

- Takes less storage space and is easier to carry

- Liquidity of currency is easier

- Now-a-days; many instruments are available through which it is not necessary to physically carry the currency

Other Forms of Money

Deposits with Banks: Most of the people need only some currency for their daily needs. Rest of the amount is usually kept as deposit in banks. Money which is kept in a bank is safe and it even earns an interest. One can withdraw money from his account as and when required. Since deposit in the bank account can be withdrawn on demand, these deposits are called demand deposits.

One can use a cheque; instead of cash to settle payments. Moreover, one can also buy a demand draft from a bank to make payments.

Credit: Banks keep a small proportion of their deposits as cash with themselves. This is usually 15% of their deposits as cash. This amount is kept as provision to pay the depositors who may come to withdraw the money on any day. This amount is enough because only a small fraction of people come to withdraw money on a given day. The rest of the amount is used by the banks to give money on credit to people who need the credit. A bank charges interest on the loan which it gives to its creditors. The interest rate charged by a bank no loans is higher than the interest rate given by it on deposits. Thus, interest is the main source of income for banks.

Credit / Debit Cards: Now-a-days, credit/debit cards are in vogue. A debit card allows you to make payments from the amount which is lying in your bank account. A credit card, on the other hand, provides money on credit. Payment through credit/debit card is done electronically and this removes the need of carrying cash.

Terms of Credit

People often need to borrow money for various purposes. Many businessmen need to borrow to buy raw materials and machinery. Many farmers need to borrow to buy seeds, fertilizers, farm equipment etc. People usually buy vehicles and houses by borrowing from banks. Thus, credit plays an important role in the economy.

Every loan agreement specifies terms and conditions; regarding the rate of interest and term of payment. In most of the cases, the banks fix an EMI (Equated Monthly Installment) for repayment of loan.

Collateral: An asset which is owned by the borrower and is used as a guarantee to a lender until the loan is repaid is called the collateral. Land, house, vehicle, livestock, deposits with banks, insurance policy, gold, etc. are examples of assets. If the borrower fails to repay the loan, the lender reserves the right to sell the collateral to obtain payment.

Terms of Credit: The terms of credit include rate of interest, collateral and mode of repayment. The terms of credit varies from one loan agreement to another and also on the nature of the lender and the borrower.

Sources of Credit

Formal Sector: The formal Sector comprises of banks and cooperative societies.

Informal Sector: The informal sector consists of money lenders and friends and relatives, merchants and landlords.

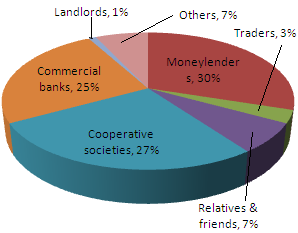

The following diagram shows share of different sources of credit in rural households in India in 2003.

While the formal sector is bound by the rules and regulations of the RBI and charge the prevalent rate of interest as per RBI guidelines; the informal lenders are not bound by such rules. The informal lenders usually charge a very high rate of interest. A higher cost of borrowing is often detrimental to the borrower. It usually results in a debt trap for the borrower. The borrower is seldom able to escape the never ending cycle of loan repayment.

Many people are too poor to qualify the requirements of credit-worthiness of banks and cooperatives. There are many others who may not have enough documents; like residential certificate or income certificate. Such people are usually at the mercy of informal lenders.

Self Help Groups

Self Help Groups (SHGs) are recent phenomena. An SHG is comprised of small number of people; like 15 – 20 members. The members pool their savings. The collection is then utilized to lend small amounts of money which may be required by any of the members. The group charges interest on the loan. The arrangement of loans through Self Help Groups is also known as micro-finance because the small amount of loan is involved.

It was the Grameen Bank of Bangladesh which began experimenting with micro-finance. The founder of Grameen Bank, Mohammad Yunus was conferred with Nobel Prize in 2006 for his efforts at improving the lot of the poor.

SHGs have helped immensely in reducing the influence of informal lenders in rural areas. Many big corporate houses are also promoting SHGs at many places in India.

Class Notes NCERT Solutions for CBSE Students

Class Notes NCERT Solutions for CBSE Students